-

Understanding Real Estate Buyer Types (Part 3): Specialist, Credit, Private Equity and Emerging Capital

Read more: Understanding Real Estate Buyer Types (Part 3): Specialist, Credit, Private Equity and Emerging CapitalIntroduction: Beyond the Core A final guide in the series for agents and advisors working across the full institutional spectrum. While much of the real estate market is dominated by institutional funds, family offices, and REITs, a growing number of specialist capital sources are influencing deal flow — particularly in complex, transitional, or structured scenarios.…

-

Understanding Real Estate Investment Funds (Part 2): Listed, Public, and Mission-Aligned Capital

Read more: Understanding Real Estate Investment Funds (Part 2): Listed, Public, and Mission-Aligned CapitalIntroduction: Diversified Mandates, Distinct Behaviours A follow-up guide for agents advising on institutional and specialist real estate transactions. In Part 1, we profiled five of the most common private and institutional real estate buyer types — from family offices to opportunistic funds. But the capital landscape doesn’t stop there. In this second instalment, we explore…

-

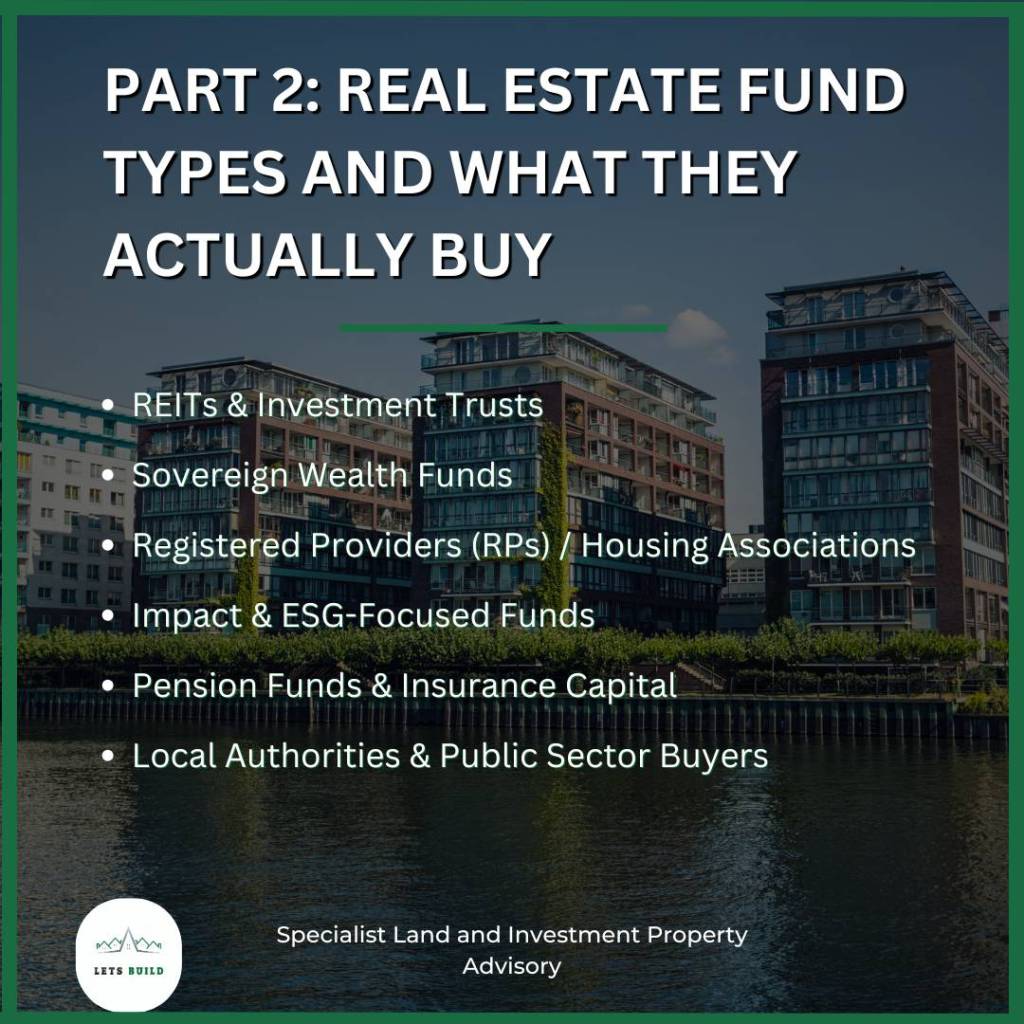

Understanding the 6 of Most Common Real Estate Investment Fund Types — And What They Actually Buy

Read more: Understanding the 6 of Most Common Real Estate Investment Fund Types — And What They Actually BuyA professional guide for agents, developers, and advisors working with institutional and private capital in today’s UK market. Introduction: Match the Buyer, Close the Deal In today’s real estate market, placing a deal is no longer just about price — it’s about alignment. Whether you’re advising on a stabilised BTR block, a supported housing portfolio,…

-

Why You Can’t Get Your Build-to-Rent Scheme Funded in the Current Climate

Read more: Why You Can’t Get Your Build-to-Rent Scheme Funded in the Current ClimateThe UK’s Build-to-Rent (BTR) sector has experienced significant growth in recent years, attracting institutional investors seeking stable, long-term returns. However, the traditional forward funding model, once a cornerstone of BTR development, is facing unprecedented challenges in the current economic climate. Developers are finding it increasingly difficult to secure funding for new schemes, as a confluence…

-

Section 106: Shared Ownership. Deal Structure and Exit Strategy for developers

Read more: Section 106: Shared Ownership. Deal Structure and Exit Strategy for developers🏡 Why Section 106 Shared Ownership is Gaining Momentum with RPs and Institutional Buyers As pressure to deliver mixed-tenure housing intensifies, many developers are turning to Section 106 shared ownership units not just as a planning obligation — but as a strategic opportunity. Shared ownership offers developers a route to de-risk schemes early, while providing…

-

Forward Funding And Forward Commit Options Explained: What You Should Consider When Looking at Partnerships

Read more: Forward Funding And Forward Commit Options Explained: What You Should Consider When Looking at PartnershipsForward funding in property development can be complex. Understand the different options such as traditional and phased forward funding, deferred purchase, forward commitment and joint ventures. Learn about their pros and cons, and how to navigate this intricate landscape.*

-

AI, Real Estate And Big Data – What Will The Future Hold?

Read more: AI, Real Estate And Big Data – What Will The Future Hold?Artificial Intelligence in Real Estate

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.